Shopify Line of Credit

Draw. Repay. Repeat.

Flexible financing is right in your admin through a Shopify Line of Credit.

Don’t have a Shopify store? Start for free, then get your first 3 months for $1/mo.Available in select countries. Offers to apply do not guarantee financing. All financing through Shopify Lending, including Shopify Capital and Line of Credit products, is issued by WebBank in the United States.

The Line of Credit made for commerce

Shopify is the only finance partner with a 360° understanding of your business, so we’ll have an offer ready the moment you’re eligible for financing.

Competitive rates

Keep more of your profits and only pay interest for what you use.

No hard credit checks

Offers are based on our unique, in-depth view of your business.

Seamless integration

Manage financing in the same admin you use to run your business.

Full control

Scale and thrive with Shopify. No equity, or stake taken—ever.

Financing that flexes with you

Plan for the unexpected with a revolving line of credit.

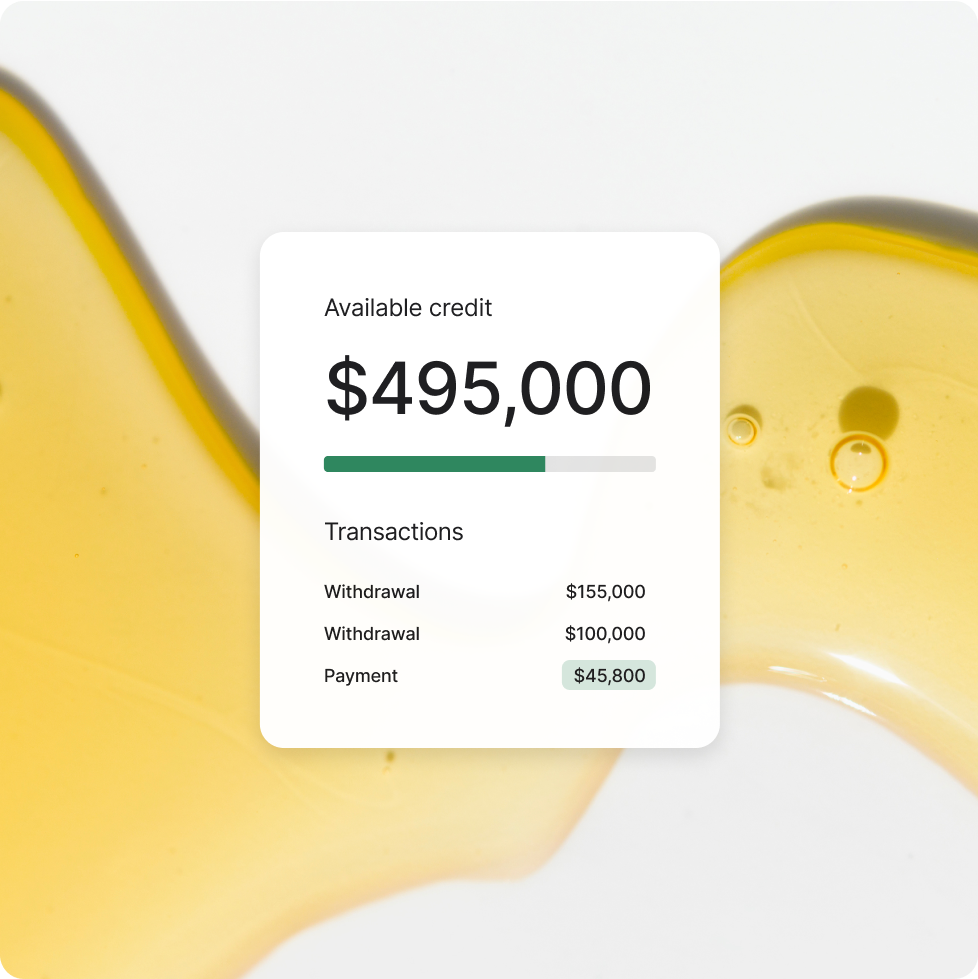

Custom credit limits

Speak to a dedicated funding advisor and tailor a limit that suits your business—up to $800K.

Access from your admin

Request the funds you need, when you need them, without leaving your Shopify admin.1

Replenishing credit limit

Anything you repay on your line of credit can be drawn again.2 Ready to repay in full? Go ahead—there are no early payment penalties.

Shopify Line of Credit gave our business the peace of mind to access funds when we need it—without all the red tape we've experienced from other lenders.

- Hatching Time

- Yagiz Aksu — Owner

Shopify Line of Credit

Get the credit you deserve

Fuel growth, optimize cash flow, and stay ahead of the commerce curve.

Resources

What is a line of credit?

Learn the definition of a line of credit and how to get the most out of this form of business financing.

Financing solutions

Learn the difference between each of Shopify’s lending solutions, and find out which one is right for your business.

Support

Detailed instructions, terms, and key information for setting up and using your Shopify Line of Credit.

Recommended for you

Hassle-free financing with repayments that automatically adjust to sales.

Turn everyday business purchases into cashback rewards with the pay-in-full card designed for entrepreneurs.

Frequently asked questions

Available in select countries. Offers to apply do not guarantee financing. All financing through Shopify Lending, including Shopify Capital and Line of Credit products, is issued by WebBank in the United States. Financing through Shopify Capital is either in the form of a merchant cash advance (MCA) or loan depending on location.

- 1If approved, funds from a withdrawal request may take two or more business days to be received.

- 2Payments towards your outstanding line of credit balance will not become available to withdraw again until your payment is successfully received, provided the amount requested is within your credit limit. Credit limits are subject to change. Withdrawal requests may be subject to additional review.

- 3Actual term may vary slightly depending on the timing of each withdrawal. Term and payment schedule reset with each additional withdrawal.