Hopefully, your clients love running their Shopify stores, especially when it comes to the more fun, customer-facing aspects. Things like the design, content, and functionality all come together to give the brand its unique feel. As a designer or developer, you play a big role making sure these things work properly.

But while design, content, and functionality are all critical to a brand’s success, there are other (slightly less fun) things that are just as important. The practical and financial aspects of running a Shopify store may not be as interesting as the storefront itself, but they can’t be ignored without serious consequences.

One of the most important practical details is sales tax compliance. If your client is not totally compliant with sales tax laws, they risk fines and other harsh penalties. Luckily, there are several things you can do when setting up your clients’ Shopify stores that will keep them safe and compliant while also keeping their sales tax streamlined and easy to manage. Here are five tips for doing just that.

You might also like: Why Freelancers Need to Care About Bookkeeping

Find out where your client needs to collect taxes

Unless your clients are based in Alaska, Delaware, Montana, New Hampshire, or Oregon (which do not have sales tax), they will need to collect sales tax on sales within their own state. In addition to collecting sales tax from customers in their home state, they will also need to collect tax in any other states where they have nexus.

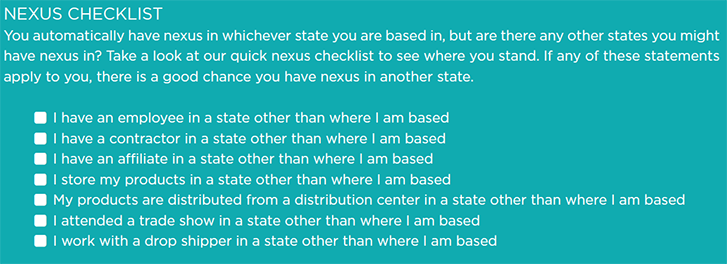

Nexus is simply a legal term for any state where your client has a legal obligation to collect and remit sales tax. This can be a bit tricky as each state has its own rules about what exactly constitutes nexus, though generally it involves having a physical presence in the state.

Physical presence doesn’t have to mean that your client’s entire business is physically located there. In fact, if your client’s business has any of these items in a specific state, they probably have nexus there:

In some states, even simply attending meetings or other business events automatically gives nexus.

If your client isn’t sure whether or not they have nexus in a state, they can double check by looking up state-specific nexus laws. If your client wants reassurance that they do or do not have nexus in any given state, they can download this guide to nexus, or even contact that state’s Department of Revenue directly.

Confirm your client has a sales tax license in any state where they have nexus

Now that you and your client know where they have nexus, it’s important to apply for a sales tax license in each applicable state. This is necessary in order to begin legally collecting sales tax.

Since each state has its own sales tax permit application process, it’s best to Google for your specific state and go from there, or click on the state-specific links in this guide. As an example, if your client’s business is located in Colorado (or they have nexus there for other reasons), googling “sales tax license application Colorado” will lead your client to the Colorado Department of Revenue website. Once there, your client can fill out and file the appropriate form, which looks like this.

Depending on the state, the sales tax permit may be free or require a small fee. Once your client’s application(s) are approved, they’ll be all set and ready to legally collect sales tax in their nexus states.

Note: Remind your clients that when they get their permits all lined up, they should make note of the filing deadlines for each state where they will be collecting sales tax. These deadlines vary by state, and can be annual, quarterly, or even monthly. Your client will want to set up calendar alerts with plenty of lead time to make sure they don’t file their sales tax late in any given state — or even worse, forget to file.

You might also like: The Case for Continual Development: The New Way to Approach Ecommerce

Set up the sales tax collection

Collecting sales tax can be complicated because rates vary dramatically from state to state, and even within states. Luckily, Shopify eliminates this problem for you and your clients. In fact, Shopify makes it easy for you to set up your clients’ cart to automatically collect the correct sales tax, allowing you to select states in which they have nexus. For complete instructions, Shopify provides you an easy step-by-step guide to this in the resources section.

Once you set this up, sales tax collection will be automated and easy for your clients. You may want to remind them that if they are also selling their products on other platforms, they will need to set up sales tax collection within those platforms as well.

Set your client up to run reports

Once your client is up and running with sales tax collection, it’s necessary to run reports that track all the sales tax collected by states. Shopify makes this simple, through the Reports page. Your client will need to run reports before each sales tax filing deadline, and also save copies for themselves in case they are ever audited in the future. You can schedule the sales tax reports to run at set times throughout the year, based on your clients’ needs.

Install a tax compliance application

It’s not enough to just collect the correct sales tax for each sale and run reports; your client also needs to file and remit sales tax by the deadline. Several applications, like Taxify, easily integrate with Shopify to provide your client with the easiest way to file and remit all of the taxes collected.

One of the huge benefits of installing an app like Taxify is that it can collect information across several platforms if the client also has POS sales or uses another platform like eBay. Taxify also ensures that by setting up AutoFile, the client will always file and remit on time, avoiding costly fines and making it much easier to keep track of everything.

Sales tax may not be the most exciting part of running an online business, but it is one of the most important. By following these steps, you will take something that would normally be a huge hassle for your client and make it easy and stress-free for them.

Read more

- Free Industry Report] The Opportunities, Threats, and Future of the Consumer Electronics Industry

- Teaching Code: A Getting Started Guide

- Free Industry Report] The Future of the Fashion and Apparel Industry

- How to Develop an Effective Creative Brainstorming Process

- Go Back to School With These Online Courses for Continuous Learning