Port delays, labor shortages, inflation, and global conflicts have all shifted how retailers successfully ship and deliver goods to consumers. 2022 has already seen a number of emerging shipping trends take off and make their way into mainstream retail: digitized supply chains, load balancing, and outsourcing fulfillment to a 3PL. Retailers that want to optimize their operations should tap into the shipping trends that make sense for their business operations.

If you’ve found 2022 a challenge, you have another chance to streamline your shipping operations in 2023. Shipping challenges are likely to improve over 2023, but your brand still should be prepared to tackle anything that comes its way.

This article will guide you through key shipping trends to shape your 2023 strategy.

What’s the current state of shipping at the end of 2022?

The COVID-19 pandemic wreaked havoc on global supply chains and shipping. Worker shortages, lockdowns, and slow port turnaround times have all contributed to global shipping delays and supply chain issues.

Throughout 2022, these problems have been felt by both retailers and consumers. According to the National Retail Federation (NRF), 97% of its members have been impacted by port congestion and shipping delays. Plus, in the US, 60% of consumers report being unable to get a product due to shortages or delays.

These delays can be detrimental to retailers. In a one survey of shoppers, 76% of respondents said that an unacceptable delivery experience would strongly or somewhat affect their decision to order from that company again.

In spite of the global situation, consumer expectations are higher than ever. Sixty-two percent of shoppers expect their orders to arrive in less than three business days when choosing free shipping. Yet more than 80% of leading fashion and apparel retailers are still using five-to-eight-day delivery options to service free shipping orders.

Post-pandemic, retailers are grappling with new and old shipping challenges while aiming to meet customer demand.

Scott Gravelle, founder and CEO of Attabotics, an inventory management robotics company, explains that large retailers continue to face pandemic-related shipping challenges. At the same time, retailers are wrestling with making accurate predictions for upcoming holiday demand.

“Supply chains are already scrambling to reorganize themselves post-COVID, and now companies are battling with the difficult task of predicting how consumers will spend for the holiday season,” he says. “If consumer spending is elevated beyond expectations, it's going to be a mess for both consumers and retailers.”

“We’ve already seen this not only with behemoths like Amazon but other stores that have increased service charges ahead of the upcoming holidays. It signifies that there will be disruptions—especially for those last-minute shoppers—and unfortunately, a lot of late presents that won’t make it in time for the holidays."

But on the positive side, shipping delays and supply chain problems look to clear up over the next year. Maggie Barnett, the COO of ShipHero, a shipping and logistics provider for ecommerce brands, explains that supply chain issues are improving over time.

“The supply chain is in a better position than in the last two years at the height of the pandemic. The US still hasn't bounced back from COVID-19, and inflation is still at a record high,” she says. “But there are signals that the supply chain is on the right track, like higher consumer spending and increasing employment numbers. And retailers are experiencing fewer supply shortages than in 2020–2021.”

Looking ahead to the new year, Maggie points out that current economic challenges are likely to impact consumer spending.

“But in any new year, there are new issues. In 2023, consumer demand will be lower due to inflation and an impending recession. Retailers may have inventory piled up in their warehouses and see slower economic growth,” she says.

“At ShipHero, we’re noticing consumers are shifting from spending on products towards services, which will impact a sector of ecommerce retailers. The other big issue is the shortage of workers across the shipping and logistics industry. If you’re a retailer that relies on warehouse or seasonal workers, you will continue to have disruptions into 2023,” she explains.

While challenges similar to those of 2022 look set to continue into the new year, some retail businesses see find their problems ease up in 2023.

Edward Routh, founder and Director at Relloe, adds to this idea, explaining that brands that have been able to adapt to the challenges of the past year probably won’t need to totally overhaul their strategies.

“Brands are likely to find the shipping industry to be more forgiving going into 2023, as overcapacity results in lower rates,” he says. “For brands that have been able to successfully navigate the logistical challenges of the past two years, an overhaul of shipping strategies is unlikely to be needed.”

“Nevertheless, brands should continue to be vigilant and safeguard against complacency, maintaining any process improvements or optimizations that were adopted over the past two years in response to shipping volatility,” he says.

Routh also explains that retailers should look at how they can simplify their overall shipping operations.

“For those looking for further improvements, two simple, effective strategies we recommend to optimize logistics include consolidating freight into fewer, larger shipments, and planning ahead to avoid paying shipping premiums or excessive storage fees.”

Before embracing 2023, take stock of the core challenges and successes of 2022. Then review the upcoming shipping trends of 2023.

11 freight shipping and container shipping trends to watch in 2023

With the shipping landscape proving to be unpredictable, it’s key for retailers to be up to date on the latest strategies and tactics.

Look out for these 11 shipping trends in 2023. Keeping tabs on shipping trends in 2023 will help your business make the right strategic choices and stay ahead of the competition.

Supply chain concerns will continue in 2023

According to our research, 39% of brands say shipping and manufacturing delays and shipping costs will continue to be a top supply-chain-related challenge over the next 12 months.

A global pandemic, war conflict, and port delays have caused a cocktail of worldwide supply chain problems. According to McKinsey, “Clogged ports, expensive cargo capacity, and emergency shipments became prevalent during the COVID-19 pandemic. Since then, the conflict in Ukraine has also contributed to product-line closures, transport delays, and spiraling input costs.”

Plus, according to Bloomberg, 77% of the world’s ports are experiencing abnormally long turnaround times. While in January 2019 an average late container ship was delayed by about four days, in February 2022, a late ship was delayed by more than a week. In February 2022, only about 34% of container vessels arrived at their destination without any delay.

These supply chain and shipping issues are unlikely to clear up overnight. Most retailers acknowledge it will take time to unravel the challenges associated with shipping delays and supply chain issues.

The good news is that many shipping and retail experts expect these issues to gradually evaporate during the next year.

Decrease in container shipping costs and backlogs

After a surge in shipping costs over the past few years, retailers are finally feeling some relief. According to the Freightos Baltic Index, a global container freight index, the current global average cost of shipping a container is $3,429, compared to $10,396 in October 2021.

Edward Routh, of Relloe, explains that an increase in shipping capacity is helping lower costs.

“Carrier profits are set to decline by as much as 80% by 2024, as new containers ordered during the pandemic become available, increasing capacity by as much as 20% over the next two years. However, rates are unlikely to return to pre-pandemic levels as long as fuel costs remain inflated by the Russia–Ukraine war.”

Shipping container backlog is also dropping worldwide. For example, at the West Coast ports of Los Angeles and Long Beach, there were just eight ships waiting to dock at the end of September. This compares to a peak of 107 in January of 2022.

While disruption in the supply chain may continue to be a hurdle for maritime shipping companies in 2023, these issues seem to be dissipating. Lower container costs and fewer backlogs should help retail brands keep shipping rates lower for consumers.

Brands embrace elastic logistics

Fresh and old supply-chain issues are causing retailers to reassess their current shipping strategies. Instead of relying on tried and tested methods, retailers need to embrace fresh solutions.

Maggie Barnett, of ShipHero, explains how in spite of recent shipping challenges, businesses have become more adaptable strategies. Instead of going for a full reinvention, the key to successfully managing challenges is to remain flexible.

“The positive thing about the last two years is that companies have gotten really good at predicting supply chain disruptions,” she says. “Brands don’t need to reinvent their shipping strategies, but they may need to adjust accordingly. Staying flexible is key to surviving the ups and downs of the pandemic.”

“Companies should be able to scale operations and resources depending on consumer demand and product shortages. 2023 will be all about elastic logistics. Companies should also consider investing in AI and cloud technologies, as these are the best ways to predict consumer demand and have total visibility into the supply chain.”

Rethinking a shipping strategy needn’t mean reinventing the whole wheel. But as the landscape continues to remain unstable and unpredictable, brands will need to embrace agility and flexibility.

Reduce carbon emissions through deliveries

Customers are increasingly concerned by the impact of their purchasing habits on the environment. People want to know what their carbon footprint is and how they can take steps to reduce it. Brands that prioritize lowering their emissions and that are transparent with customers about their sustainable values will encourage like-minded consumers to shop with them.

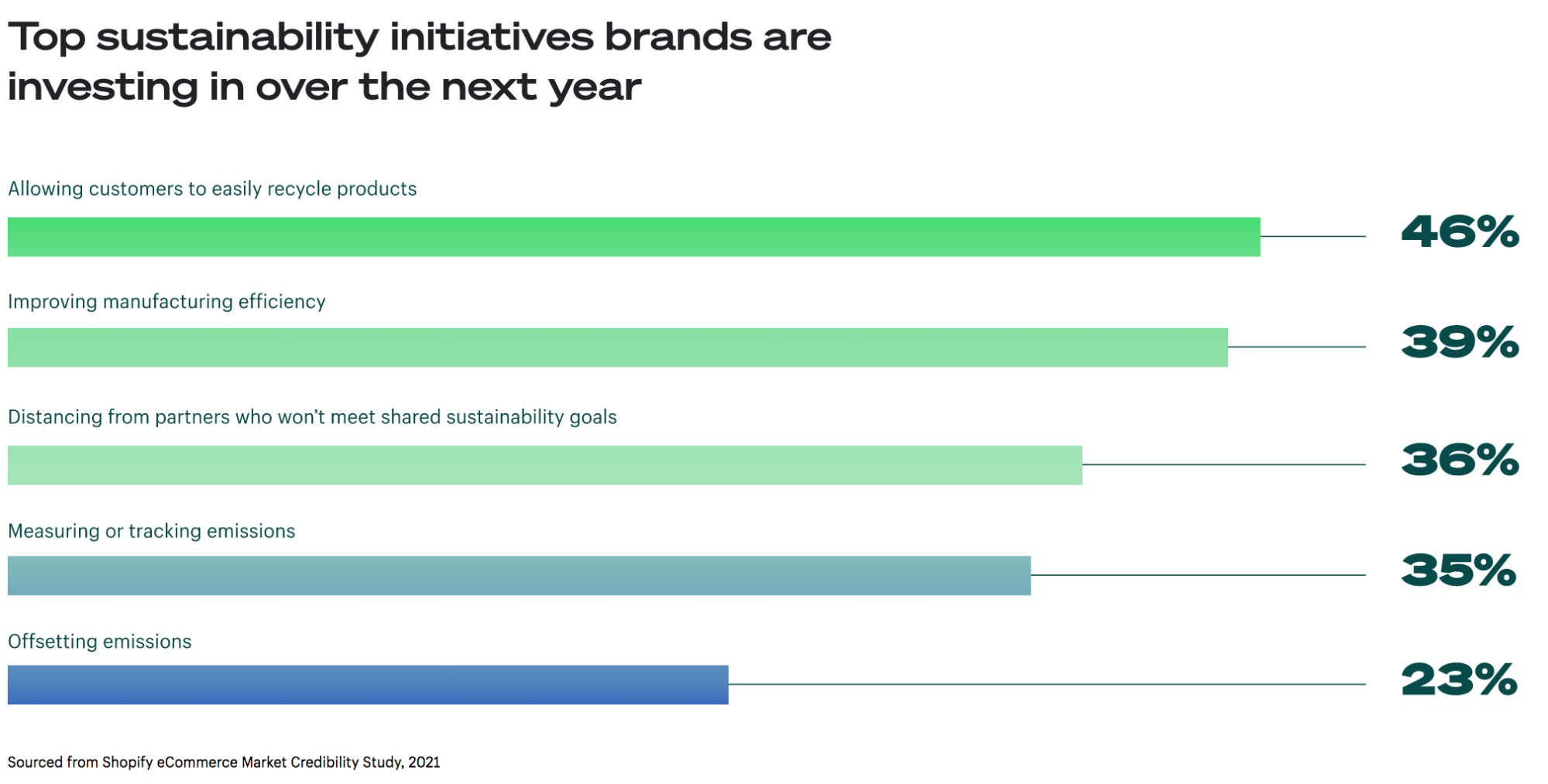

When surveyed about their plans for taking sustainability initiatives in 2022, 35% of brands said they would prioritize measuring or tracking emissions. Another 23% said they would focus on offsetting emissions.

Parcel deliveries are one way customers can reduce their emissions and make more environmentally conscious decisions.

The World Economic Forum estimates that parcel deliveries will increase by 78% globally by 2030, resulting in 32% more emissions. But 42% of consumers we surveyed said that “knowing a brand is actively working on reducing their carbon footprint” is important when deciding whether to purchase a product online. One way to address your carbon footprint is through offsetting. Currently, only 23% of brands are offsetting emissions, but this is predicted to grow significantly in the years ahead.

One of the first places brands can look to reduce impact is in last-mile deliveries. To reduce your carbon footprint, you could join IKEA, Walmart, and UPS in electrifying your delivery fleet. According to a 2020 study conducted by the MIT Real Estate Innovation Lab, this technology can now decrease ecommerce delivery emissions by 27%, and by considerably more as the electricity grid is decarbonized. Newer electric vehicles have a range of 200 miles, capable of handling 90% of all last-mile deliveries. Scooters and bicycles can also be used.

Retailers that don’t own a delivery fleet can reduce their footprint in their fulfillment processes, like decentralizing inventory centers, using parcel lockers, or working with a 3PL. Not only will your customers receive their goods faster, but building out logistics networks, including urban fulfillments centers, can reduce transportation-related emissions by 50%.

Sustainable packaging to grow in importance

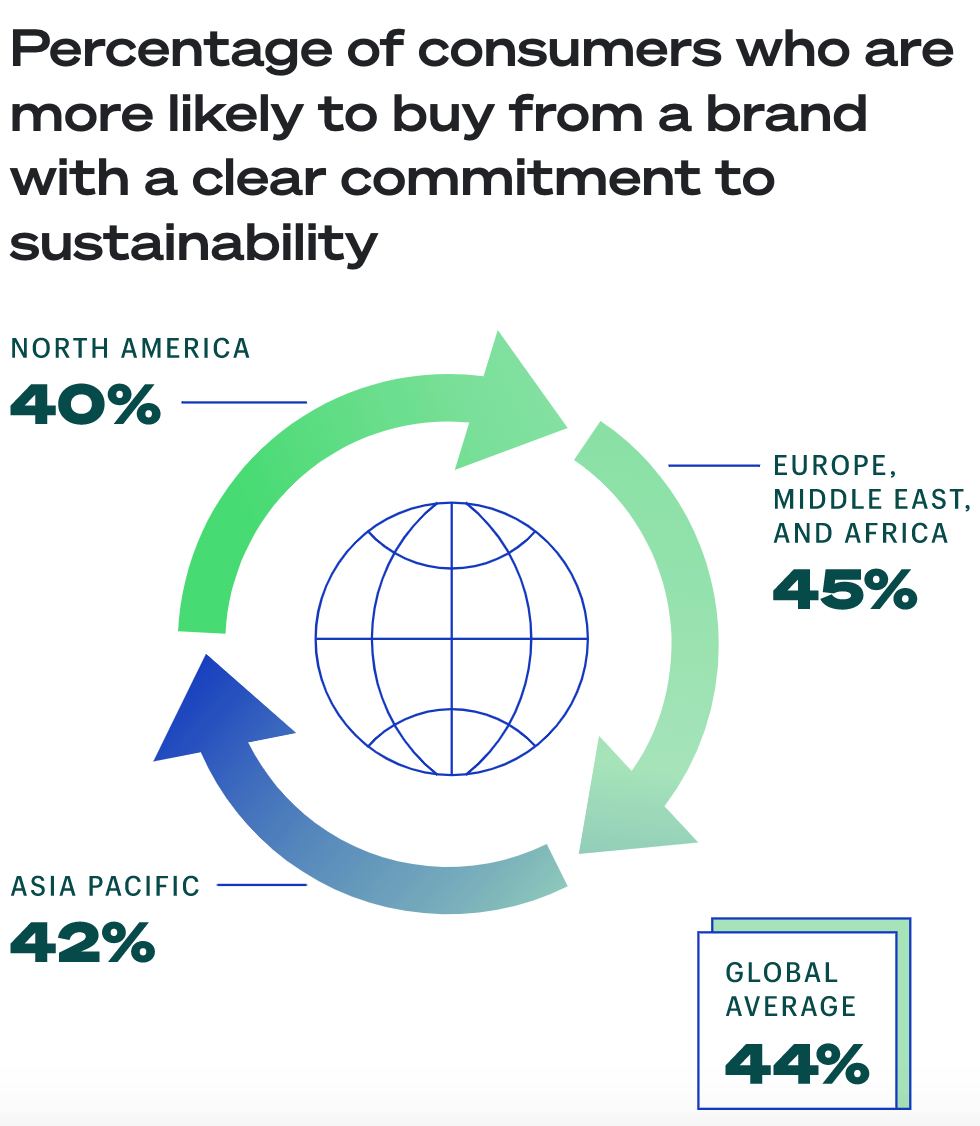

Currently, 44% of global consumers are more likely to buy from a brand with a clear commitment to sustainability. Prioritize sustainable values and show customers the ways your brand is acting in favor of the environment.

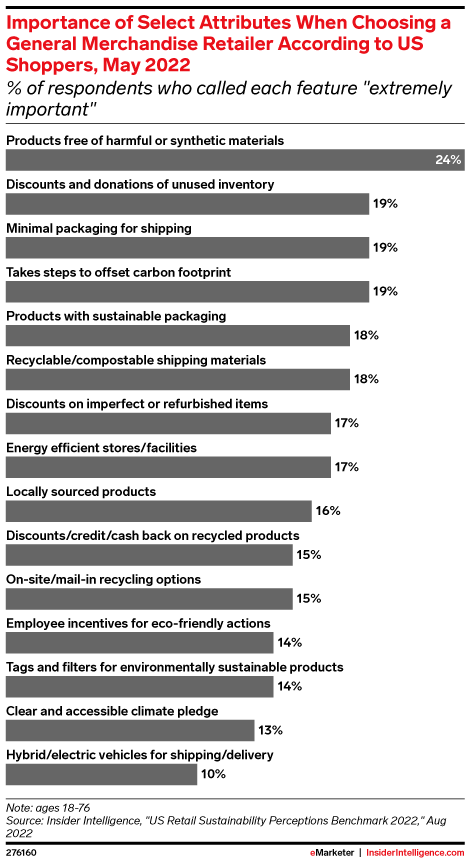

Plus, according to eMarketer, 19% of US shoppers believe that minimal packaging for shipping is extremely important. Eighteen percent of respondents also cited products with minimal packaging as extremely important.

In 2023, sustainable packaging is set to become one of the core industry trends. Brands need to pay attention to the materials they’re using to package goods, as well as the recycling instructions they provide.

According to our research, 46% of customers are more likely to purchase a product online if they’re able to recycle the product packaging. This is part of the reason why 40% of brands are highlighting more sustainable packaging as an area of investment.

The issue is bigger than consumer demand, though. Packaging is the largest source of ecommerce emissions, at six times higher than products purchased in store.

Now is the time to re-examine how you’re packing and shipping products, whether that’s using compostable or recyclable mailers or looking into reusable packaging, another method of supporting the circular economy.

Brands need to make their values on sustainability clear to customers. People want to be able to identify with their chosen brand’s values.

Of the consumers we surveyed, 41% said a significant influence on their purchasing decisions in the past year was when a brand made it “easy to understand the actions they are taking to achieve their environmental and/or social impact goals.”

One brand that prioritizes sustainable shipping choices is A Good Company. Along with providing full supply chain transparency, founder Ankarlid sees an opportunity to help consumers make more informed, responsible choices. He notes that this will become more important because “people are going to become more cautious about what they buy and for what reasons.”

A Good Company applies this logic to its delivery and returns policy, which, Ankarlid admits, can be a “conversion killer.” He explains, “We don’t believe it’s OK that you buy one notebook and expect free shipping—that’s not sustainable for anyone. So we incentivize our customers to buy a little bit more at the same time. That way they get better bulk pricing and we can ship the order in the most sustainable way possible. A lot of what we do is to influence consumers to calm down, take a chill pill.”

By placing their sustainable shipping and returns values at the forefront of their offering, it’s easier for customers to buy into the brand and decide whether it aligns with their own personal values.

Transparency around delivery times

Customers expect clarity around parcel delivery dates. When brands fail to deliver on time or set unrealistic expectations, they risk customer relationships and increase the chance of shoppers going elsewhere. While shoppers prefer free and fast delivery, this shouldn’t be exchanged for full transparency around realistic delivery times.

If it will take your brand ten days to ship a certain product, then tell your customers at the checkout––not after the product’s expected delivery date.

A customer’s trust in a brand can deteriorate quickly if brands aren’t able to fulfill their delivery promise. Plus, customers are becoming increasingly picky about accurate delivery times. A 2020 survey found that when packages are delayed but consumers aren’t informed, 69.7% of customers would be less likely to shop with that retailer again.

Lack of clarity around shipping loses sales. In the past year alone, 32% of the customers we surveyed abandoned their carts because “the estimated shipping time was too long,” and 22% because “there was no guaranteed delivery date.”

In 2023, building trust and transparency through delivery-related communications will be critical to developing long-term customer relationships strong enough to withstand the industry’s current challenges.

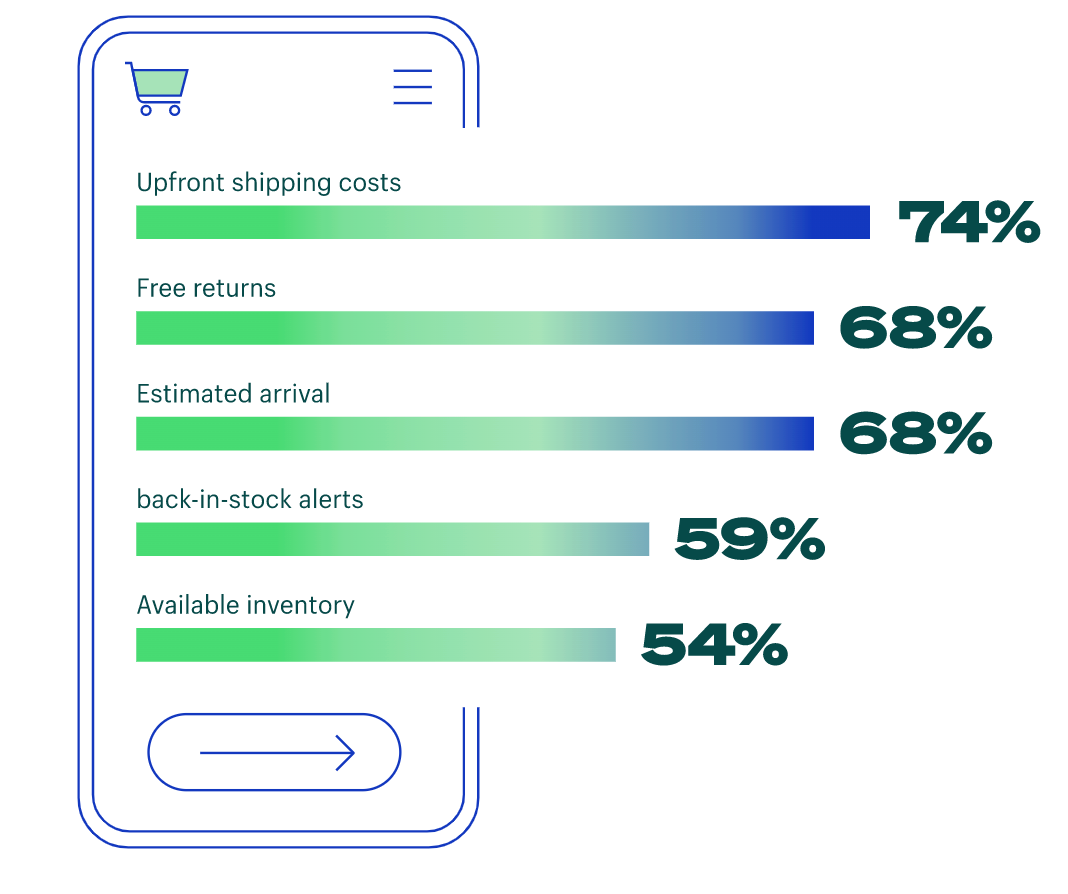

Customers report that two of the most important qualities when they shop online are cost and estimated time of delivery: 74% of consumers surveyed are influenced by price, while 68% are influenced by estimated time of delivery.

Get products to customers more quickly

As shoppers continue to rely on online shopping, they don’t just want accurate delivery date predictions, they expect fast shipping too. Consumer expectations around fast and efficient delivery continue to increase.

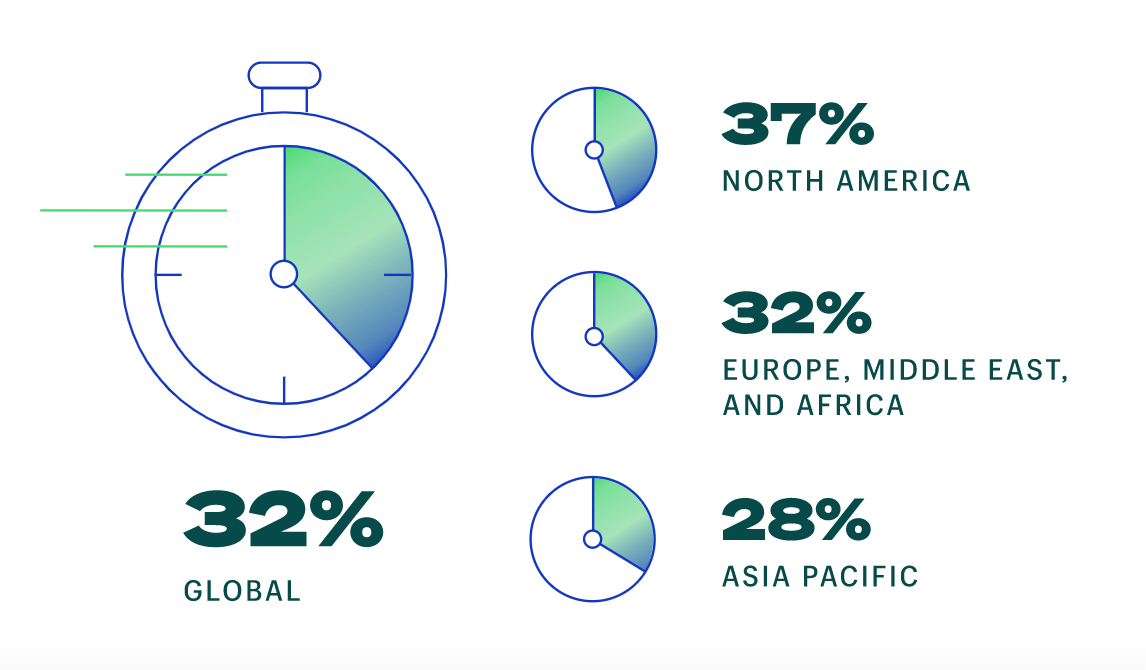

In fact, around 32% of global shoppers have abandoned a purchase because the shipping was too long. This increases to 37% in North America.

There are more new online shoppers than ever before, with 90 million more digital buyers today than in 2020. And thanks to industry leaders, they’ve already been conditioned to expect fast, free, on-time delivery.

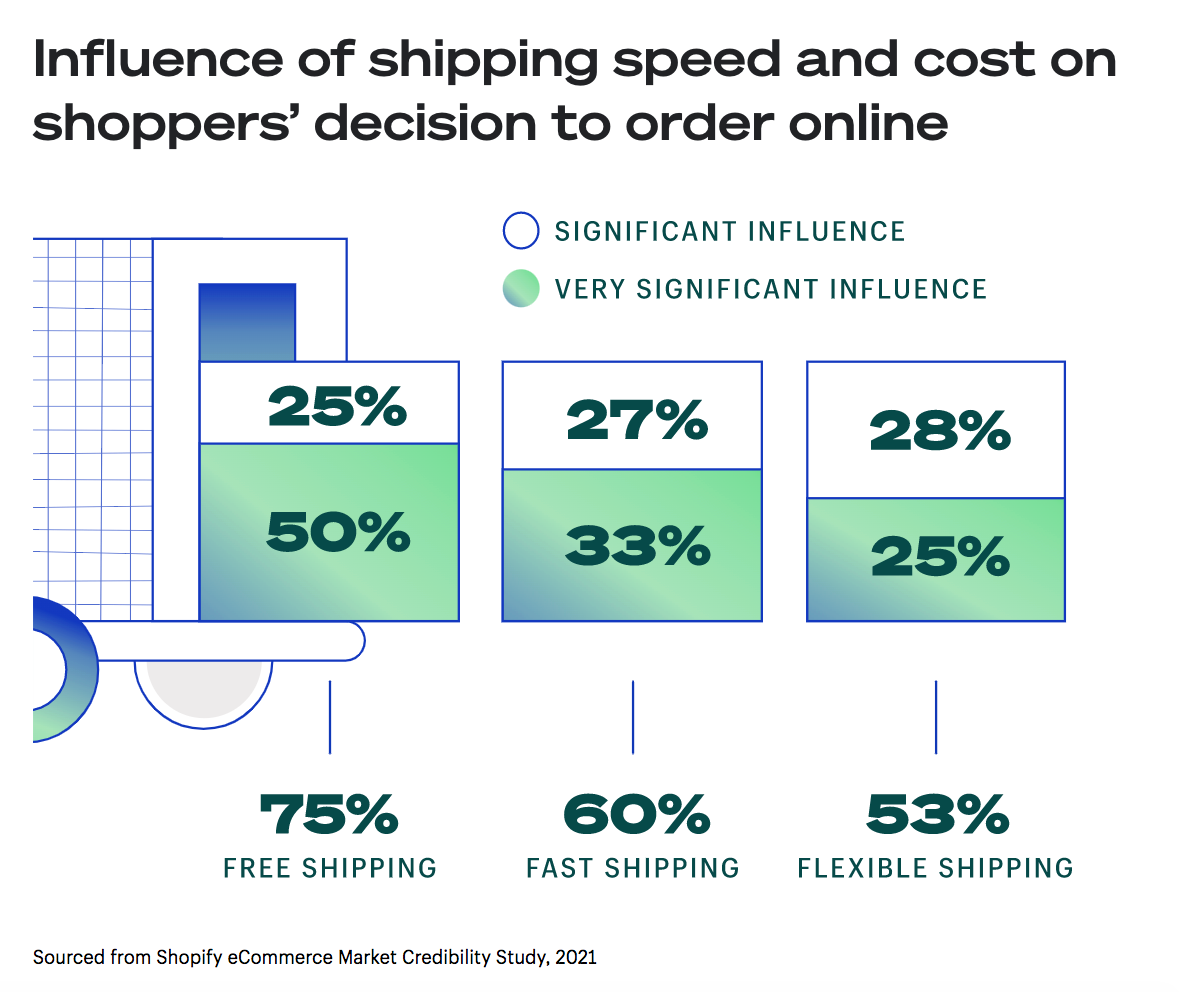

According to our research, free shipping continues to have a significant influence on purchasing for 75% of global shoppers, with 58% of people expecting free next-day delivery.

While customers may continue to expect free and fast shipping in 2023, it shouldn’t come at a cost to brands’ environmental values.

Better distribute the supply chain

Supply chain distribution describes how brands get products to customers. To improve efficiency, retail brands need to consider how they can better distribute their supply chain. With a solid inventory distribution plan that's properly implemented, brands reduce their cycle times for product deliveries.

There are four main ways brands can choose to market their products:

-

Direct sales

-

Wholesale

-

Brokerage

-

Dual distribution

Brands need to take care to choose the right supply chain distribution partner. Some businesses may prefer to sell products directly to consumers, while others may prefer to outsource distribution to third-party companies.

Scott Gravelle, of Attabotics, explains that businesses need to analyze how they can better distribute their supply chains and optimize their processes.

“There is a massive rethinking and reconsideration about how companies can distribute their supply chains, especially on a global scale,” he says. “Currently, supply chains are often made of legacy, centralized distribution centers—warehouses where operations are limited to one, central location, or just a handful—lacking the flexibility and data to adapt to market demands quickly.”

Scott also explains that opting for smaller decentralized distribution centers can help retailers make better data-informed decisions.

“We are also seeing that with the help of Attabotics and others, more and more decentralized distribution models are popping up closer to urban areas such as city centers,” he says. “Decentralized distribution models, otherwise explained as ‘mini’ fulfillment centers, can be strategically placed around various locations, leading to products existing closer to the end user—and each other—therefore offering a much more agile restocking, redistributing, and shipping process. These smaller distribution structures also allow for better data-driven decision making instead of using one, centralized source.”

Maggie Barnett, of ShipHero, also agrees that distributing the supply chain across multiple locations can help reduce a business’s overall risk.

“Companies can lessen the impact of supply chain disruptions by spreading their inventory across multiple warehouses and utilizing different manufacturers and shipping carriers. This diversification will help companies prepare for the unexpected,” she explains.

Brands should also focus on how they can use technology in their supply chain to speed up operations and lower their environmental impact at the same time.

“For example, an [Internet of Things]–enabled supply chain connected to a 5G network would also be able to deliver that vital information in real time, therefore reducing the carbon output from last-mile delivery,” Scott explains. “Using medium- and heavy-duty trucks for last-mile delivery makes up nearly a quarter of the carbon footprint caused by transportation.”

Shift to just-in-case inventory management strategies

Adopting just-in-time inventory (JIT) management tactics may seem appealing during uncertain economic periods. After all, they provide your brand with flexibility during unforeseen circumstances. But they also leave your brand without guaranteed inventory levels, which can be risky during peak seasons.

Edward Routh, of Relloe, explains that retailers have needed to shift their inventory management strategies. Instead of relying on last-minute tactics to appease emergency situations, he suggests using other more sustainable approaches.

“Brands were forced to reflect on their inventory management methodology in response to the challenges of the past two years,” he says. “Aggressive adoption of a just-in-time inventory management model resulted in razor-thin inventory levels. While a JIT approach is appealing, it can often lead to an overreliance on timely replenishments and lead to little to no buffer to withstand even the smallest of supply chain disruptions, let alone a global pandemic.

“Shifting from ‘just-in-time’ to a more stable ‘just-in-case’ model allows brands to respond to more supply chain setbacks. While it may be impossible to insulate one’s company from another global pandemic, operating with more robust inventory levels may help companies to overcome supply chain obstacles and maintain the integrity of fulfillment channels.”

Load balancing as a popular fulfillment method

As retailers look for ways of lowering their shipping and warehouse costs, load balancing is becoming a popular fulfillment method. Load balancing means efficiently distributing incoming inventory across a group of distribution centers, instead of all inventory going to the same warehouse,

Maggie Barnett, of ShipHero, explains that load balancing can help retailers save money on shipping costs as well as get the right products to customers more efficiently.

“Load balancing is a fulfillment trend that's on the rise,” she says. “Load balancing your warehouse can save your company up to 25% on shipping costs and is a more strategic way to get the right products closer to customers, as well as cut down on shipping costs. It may also improve customer satisfaction as their products arrive with quicker delivery times.

“Load balancing itself won't solve the supply chain issues, and it’s important for ecommerce brands to use a WMS and fulfillment partner to make sure they're getting the most out of it.”

Outsource shipping and fulfillment to a 3PL

Once, third-party logistics providers were considered only a solution for enterprise-sized retailers. But 3PL providers are now considered essential for growing merchants of any size looking to scale.

In fact, the 3PL market is expected to expand at a compound annual growth rate of 8.5%, with the fastest growth taking place in Asia Pacific. Globally, 37% of surveyed merchants plan to hire or change 3PL or fulfillment providers in the coming year.

With pre-negotiated contracts and a network of fulfillment centers spread across the country and around the world, using a 3PL can offload the time and stress of managing shipping logistics in house, while keeping costs down. 3PLs with their own delivery vehicles are also investing in smaller trucks and vans, which can support shorter distances and more frequent deliveries.

Working with a 3PL can also help retail brands test new markets without needing to invest in infrastructure or figure out the regulations of overseas markets.

During unstable economic periods, collaborating with a 3PL can also help diversify your risk. Since 3PLs usually have relationships with multiple shipping carriers, it protects your brand from large shipping surcharges.

What will global shipping look like in 2023?

As we close out 2022 and head into 2023, keep these shipping trends in mind so you can start implementing them over the course of Q1. Ensuring you’re on top of new shipping strategies will help your business optimize its operations and provide a better customer experience.

To make it easy for your brand to scale its fulfillment and shipping services, try Shopify.

Shipping trends FAQ

What have been the core challenges of shipping in 2022?

As a result of a global pandemic, war conflict, and inflation throughout 2022, retail brands faced multiple shipping challenges including:

-

Truck driver shortages

-

Soaring freight rates

-

Port delays

-

Worker shortages

Are shipping costs falling?

Shipping costs are falling as global trade rates decline and demand for goods shrink. Freight rates are also going down as a result of fewer supply chain disruptions.

Is the shipping crisis over?

No one really knows when the shipping crisis will end. But fewer port delays, supply chain issues, and more available workers are helping improve the international shipping crisis.

Is the supply chain getting better?

As the global pandemic winds down, supply chain issues are gradually improving. But unpredictable events like war conflict, natural disasters, labor strikes, and other geopolitical issues could cause further supply chain problems.