Editor's Note: This post was originally published in August 2018 and has been updated for accuracy and comprehensiveness.

With an estimated 12,000 retail locations expected to close in 2019 and retail sales growth slowing, legacy manufacturers and CPG companies are accelerating their direct-to-consumer (DTC) efforts. While ecommerce represents less than 5% of overall CPG sales, the DTC movement accounts for 40% of the sales growth in the sector.

It means DTC punches well above its weight.

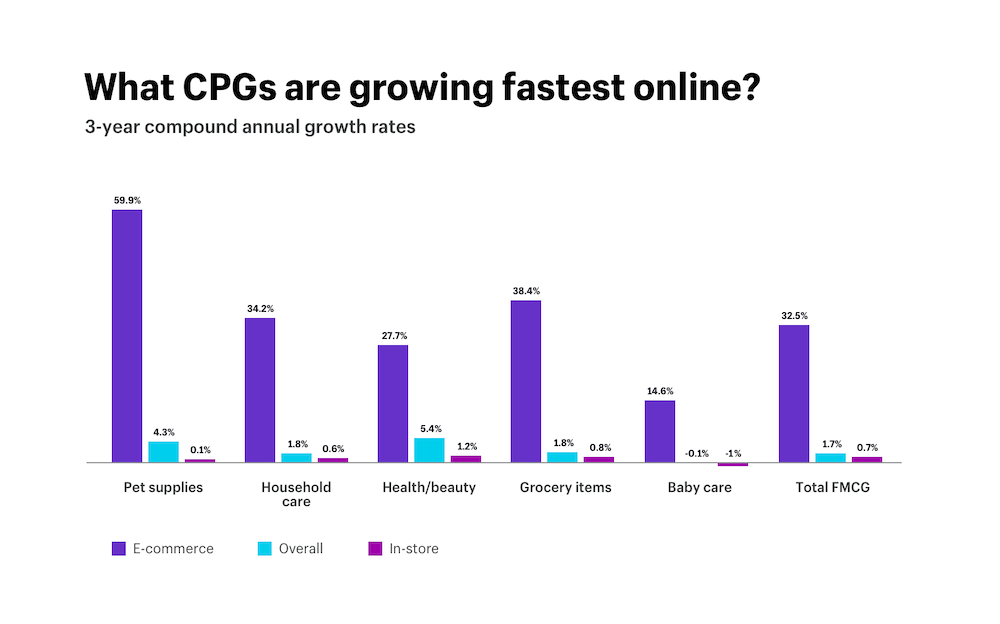

Notice how much faster ecommerce is growing for CPG companies in the following sectors:

Image via: Digital Commerce 360

Retail closures and decelerating sales growth are just two catalysts powering the DTC movement. Retail partners are now offering their own brands to compete, and there’s new competition from digitally native vertical brands (DNVBs). So selling direct is the single greatest opportunity legacy manufacturers have to reignite growth.

To help you capitalize, we’ve divided this report into three parts:

Direct-to-Consumer Data

Ecommerce currently accounts for 11.1% of total U.S. retail sales. By 2021, it’s expected to grow to nearly 14% of overall sales:

Image via: Statista

It means that while ecommerce is growing rapidly, the majority of retail transactions still occur in brick-and-mortar stores. It’s essential that legacy brands and manufacturers evolve with this trend and execute an omnichannel commerce strategy — meaning legacy brands and CPG companies must integrate a DTC strategy while maintaining their existing retail partnerships.

It’s ecommerce growth that is helping legacy manufacturers offset stagnant in-store sales growth.

Image via: Digital Commerce 360

Importantly, selling direct is also crucial in response to increased competition from retail partners offering their own DTC private-label brands.

Image via: eMarketer

To better understand this threat, look no farther than Costco’s Kirkland Signature brand, which generated nearly $40B in sales in 2018, more than CPG heavyweights Campbell Soup, Kellogg, and Hershey combined. Kirkland brands are often 20% cheaper than national brands, forcing CPG companies to cede market share or lower prices to compete.

This pressure on CPG companies is not expected to subside. Notice that Amazon’s private-label share of CPG sales is only 1%. However, scaling its private-label CPG sales appears to be a priority, according to these growth rates:

Image via: eMarketer

As is the case with brick-and-mortar retail partners, CPG companies and legacy manufacturers must also develop a strategy for selling through and competing against Amazon. Part of that strategy is understanding which incentives drive online CPG sales.

Image via: Digital Commerce 360

More than half of consumers plan to download coupons and compare prices online before purchasing CPGs. This implies possible margin pressure, but it also shows that consumers are increasingly willing to purchase from you directly online.

Benefits of DTC Ecommerce

The fear about going DTC is that doing so can cannibalize retail sales and alienate loyal distribution partners. But retail partners may actually be cheering your DTC efforts as long as you execute them in ways that are mutually beneficial.

Learn how to maintain strong retail relationships while going DTC.

In addition to potentially bolstering existing retail relationships, the benefits of going DTC include:

Benefit #1: Collecting customer data

Selling direct allows you to collect first-party data that you can use to personalize the customer experience, and ultimately monetize that relationship. Data including social profiles, psychographics, and demographics allow brands to target, tailor, and communicate with customers who are increasingly willing to purchase from CPGs online:

Image via: eMarketer

Selling direct on a commerce platform that connects digital marketing efforts with historical customer behavior positions you to minimize returns by personalizing the end-to-end experience. In addition to marketing, first-party data can inform upsell and cross-sell opportunities. It can also inform the product roadmap. For instance, customers may routinely search your storefront for an item you don’t currently sell or offer in a desired assortment.

Benefit #2: Owning the customer relationship

Selling direct allows brands to own the customer relationship instead of ceding it to a retail intermediary. With a direct customer relationship, you no longer have to rely on retail partners to protect and promote your brand. Establishing a direct relationship with the end consumer positions you to offer service and support after the sale as well.

It’s important to engage customers in a constant dialogue, from targeted marketing to retention-focused follow-up efforts. These relationships are foundations that can insulate you from shifts in technology.

Owning the relationship also allows you to lead with your values and align your brand with a social cause that resonates with like-minded consumers. Consumers increasingly want companies to act as good global citizens. Not only do they want brands to align with causes important to them, they also seek out brands that employ green manufacturing practices, ethically source their goods, and treat their workers well.

Importantly, evidence indicates consumers are willing to pay a premium for goods produced in such a manner:

Image via: eMarketer

Benefit #3: Personalized products

In addition to differentiating your DTC offering from that of retail partners, selling direct lets you personalize your product. Customers could design custom packaging, or mix and match custom assortments—an experience they can’t get in brick-and-mortar stores.

For example, The New York Times uses Shopify to execute its DTC ecommerce strategy. Readers of the newspaper’s food section can create personalized cookbooks that include their favorite recipes.

Benefit #4: Introduce new and premium products

Similar to customization, differentiate your DTC offering by creating a premium product. For example, Dirty Lemon, a wellness beverage brand, sells its drinks for $10 a bottle. The company says it has sold two million bottles since launching in 2015.

Besides attracting a celebrity following, the company only accepts orders via text message, which adds to the brand’s premium feel. It recently experimented with a cashless pop-up store where customers grab what they want and let the company know via text:

Image via: CPC Strategy

DTC is still in its infancy for many legacy manufacturers and CPG companies. Here’s how some are making the transition.

12 DTC Enterprise Examples

- K-Swiss

- Nestlé

- ABSOLUT

- Maille (Unilever)

- Budweiser

- CoverGirl

- Lay’s Potato Chips

- Cheetos

- Seventh Generation (Unilever)

- Oreo (Mondelez International)

- General Electric

- Swash (Whirlpool Labs)

K-Swiss

Introduced in 1966, the K-Swiss Classic was the first all-leather tennis shoe. It quickly gained worldwide acclaim and became a style statement both on and off the court. More than 50 years later, K-Swiss’ modern brand mission—and its DTC strategy—is to outfit and inspire the next generation of entrepreneurs.

Instead of selling through retail partners, K-Swiss partnered with popular entrepreneur Gary Vaynerchuk to create the world’s first signature sneakers for entrepreneurs and sell them directly. To enable fast-paced growth, K-Swiss and its two sister brands, Supra and Palladium, replatformed to Shopify earlier this year.

With an aggressive timeline, the company leaned on Shopify Agency Partner Guidance for front-end development, customizations, and back-end integrations including:

In the end, all three websites—in multiple languages and currencies—were launched in just five weeks.

Nestlé

Nestlé, the parent company of many popular CPG brands, wanted to stand out from the myriad home-brewed coffee choices. So they chose Shopify to power their Nescafé online store – selling coffee and merchandise direct-to-consumer with a custom platform designed for them.

For the first time in its 153 year history, the company spoke directly to millennials and invested in social media. The initial goal was to give away 21,000 coffee samples over the course of one year. Within a few hours of launching, the company met 90% of its goal and the campaign had to be shut down early. Many campaign samplers are now Nescafé customers.

ABSOLUT ELYX

What started as a holiday campaign turned into a foundation for Absolut Vodka’s DTC strategy. Through its ABSOLUT ELYX line, the company allows customers to purchase gift sets year-round. The gift sets are unique to the company’s website, to preserve its relationship with retail distributors.

Besides yielding a direct relationship with the consumer, Absolut’s DTC strategy has generated media coverage—from Elle Decoration, Forbes, Marie-Claire, Cool Hunting, and more— which contributed to this shift in marketing.

Maille Mustard (Unilever)

Since 1747, Maille Mustard has been selling through distributors to its loyal customers. Its parent company, Unilever, now sells premium and unconventional mustards directly to consumers via its own branded website. The premium products have a big impact on margins and offers the customer a price point that may not be appropriate for retail partners. DTC also allows the company to pursue partnership opportunities that typically don’t happen via retailers.

Unilever also uses Shopify to power a DTC store that is paving the way for how the brand interacts with their customers in the future.

Budweiser

Budweiser’s first-ever DTC effort included its new experiential Red Light , a novelty device that lights up and sounds off every time a customer’s favorite hockey team scores a goal. Dubbed “the next best thing to sitting behind the glass” the effort is designed to create a branded customer experience.

As the unofficial beer of sports, Budweiser has specialized in unique, surprise-and-delight moments for customers. Although their ecommerce store doesn’t sell many items, it’s a great way for Bud to interact with their die-hard fans and collect data.

In turn, customers can get their Bud gadgets direct from the source with a truly on-brand experience.

CoverGirl

Historically, beauty and cosmetics brand CoverGirl has only been sold at big-box distributors and online marketplaces. By leveraging existing celebrity endorsements, CoverGirl was able to experiment with DTC quickly and, with the help of ecommerce agency One Rockwell, launched Shop CoverGirl in just four weeks.

They’ve also created standalone sites for product drops—like Melting Pout Metallics—and limited-runs, like their collaboration with pop star Katy Perry.

Lay’s Potato Chips (PepsiCo)

PepsiCo’s Frito-Lay built off its initial DTC success by unveiling more than 60new potato chip bags that featured 31 “Everyday Smilers,” in a campaign to donate up to $1M to the charity Operation Smile. It’s devoted to providing surgeries to children with cleft lip, cleft palate, and other facial issues that impact their smile and self-esteem.

The idea is to “share a smile” featuring real people on selfie-inspired bags. For each bag purchased, Lay’s makes a donation to the charity. Consumers can learn more about the Everyday Smilers depicted on bags through an augmented reality experience powered by the Facebook Camera, and triggered by scanning a unique QR code on the back of each Smiles bag.

Image via: Lay’s

The DTC effort changed the way the brand interacts with customers and has evolved to include pop-up like brick & mortar experiences where fans can engage further with the brand.

Cheetos (Frito-Lay)

Not only has Cheetos gamified its DTC effort, the company interacts with customers in a way most would never expect—it invites people to look hard at their favorite snack, instead of immediately eating it. Cheetos created a contest platform where customers can submit the most unique Cheetos Crunchy shapes they find for a chance to win $25,000.

The brand built off of its initial success to create a Cheetos Museum, where consumers can enter to win what they see. Customers send photos of unique Cheetos snack shapes, along with a description, for a chance to win something related to whatever it is they think they see.

Image via: A List

Seventh Generation (Unilever)

Seventh Generation offers a line of feminine hygiene products from Unilever. What makes this a stand-out is the customization of their monthly (or bi-monthly) box subscription. By encouraging buyers to take a quiz, the company can pre-determine items to be delivered in a customized kit every month.

What really makes this DTC venture special is the education component they offer. The goal is to educate women by helping them understand exactly what’s in the product they use. Seventh Generation says it’s championing ingredient disclosure so women can make informed decisions and live healthier lives.

Oreo (Mondelez International)

To mark their centenary, the Oreo brand sold cookies directly to consumers for the first time ever, offering customized packaging as well as experiential booths at festivals and events across the country.

They chose Shopify to enable the “Oreo Colorfilled”, a DTC campaign allowing consumers to customize their cookie packaging and add personalized notes—and launched in a matter of weeks.

C by GE (General Electric)

General Electric (GE), founded in 1892, recently launched its DTC smart-lighting brand, C by GE, to build a direct relationship with consumers. The brand offers Bluetooth-connected light bulbs and switches that can be controlled from an app and built specifically to integrate with the Google Assistant.

Image via: GE

WithC by GE, the company is educating customers on how smart lighting can help the environment, and help the consumer save in the long-term. On the back-end, it also allows brands by GE to grow a database of forward-thinking customers who are savvy to the benefits of these products for future launches.

Swash (Whirlpool Labs)

Whirlpool Labs Innovation launched Swash forcustomers to buy cleaning accessories directly from Whirlpool. Swash allows for a quick 10-minute cleaning and dewrinkling of your clothes for those last-minute needs. And it saves consumers from sending clothes to the dry cleaners.

Since launching, Whirlpool has since added two more DTC stores for its brands Zera and Vessi.

The lessons from Swash are important: (1) as a new line in the laundry segment, it’s important to educate customers on how this product is to be used and its benefits (no more dry cleaning?!), and (2) it’s a successful example of selling a new-to-market item, at a premium price, with a subscription model so they never run out of Swash pods.

Many ways to profit with DTC

Selling direct is much more than offering an online storefront. Part of selling direct to the consumer is selling wherever they are, or on any screen. In addition to selling through their brick-and-mortar partners, DTC brands are increasingly selling in the physical world. Besides kiosks, special endcaps, and stores within stores, DTC brands are increasingly launching pop-up stores or opening flagship locations aimed at offering a branded experience that will ultimately be enhancedin the digital world.

Image via: eMarketer

Regardless of whether you’re selling direct in the digital or physical world, remember that successful DTC strategies often include:

- Offering a differentiated product or service that can’t be found elsewhere

- Leveraging first-party data to address a pain point or solve a problem

- Creatively and authentically marketing and engaging with consumers interactively

- Testing and optimizing different offerings, marketing campaigns, and value propositions

- Helping consumers become part of a larger social movement or charitable cause

Selling direct isn’t really about selling. Today’s consumer needs to feel you. They need to connect emotionally with you. Create an environment where this bond can blossom, and selling will feel effortless.

Profits without Pain with D2C Ecommerce

With the growing trends of D2C, brands need to embrace this new way of business in order to appeal to their customers, while using this channel symbiotically with retailers and other partnerships.

Your customers want to interact directly with you, so give them the opportunity.

Download the full D2C report here

If you have questions about D2C ecommerce please get in touch with Vanessa Buttinger, our resident DTC Brand Expert.